Tracking MLCC forecasts shows growth in 5G demand and volatile materials costs. This might put MLCC demand on track to outpace supply into 2022.

Shortages in multilayer ceramic capacitors (MLCC) first emerged in 2018, when demand outpaced supply. At that time, three suppliers held 60% of the MLCC market, which resulted in specialized MLCC production that limited overall supply. Over the next two years, manufacturers increased supply and the market evened out in 2020, only to take a hit from the logistics challenges of the COVID-19 pandemic. 2021 brought another round of MLCC supply shortfalls. Tracking MLCC forecasts now into 2022 shows increasing demand, paired with ongoing volatility on the supply side. This could result in imbalances in the MLCC market in 2022 leading to shortage conditions.

Tracking MLCC forecasts: 5G will continue to drive demand

MLCC usage show heavy consumer demand; 64% or so of MLCCs are consumed by consumer electronics, especially smartphones which occupy 39% of total consumption, according to an industry report from Research and Markets.

While MLCCs are found in a wide range of devices, from TVs to industrial robots and electric vehicles, the current MLCC demand seems particularly driven by the growth of 5G technologies. The demand for consumer electronics has, in turn, raised demand for smaller MLCCs to power these increasingly advanced consumer devices. For example, iPhone MLCC usage has steadily increased, with the iPhone X using up to 1,100 MLCCs versus an iPhone 5S, which requires only 400 MLCCs.

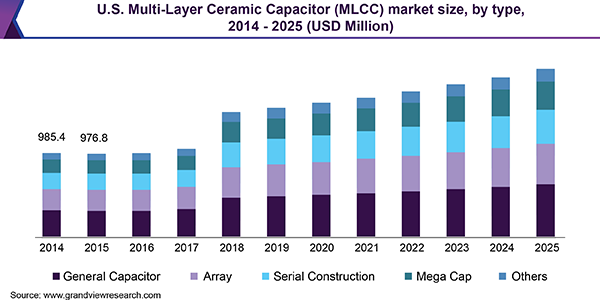

With demand for smaller, faster devices, MLCC usage in consumer electronics will continue to go up to meet the requirements of 5G technology. In 2019 Grandview Research forecasted steady growth in the demand for MLCCs with an anticipated market size growth of 5.1% by 2025. 5G growth is a primary driver behind this demand, bringing the total value of the market to an expected $12 billion in the next three years.

Potential for raw material pricing to create supply-side impacts

In addition, passive electronic components require raw materials that are variable in costs. MLCCs in the base metal electrodes (BME) and palladium group metals (PGM) are both susceptible to price fluctuations. Palladium prices have shifted significantly in late 2021, dropping steeply after reaching a record high in May 2021. This was in part due to the slowdown in the automotive industry.

The overall decreased manufacturing caused by the chip shortages, in turn, reduced the demand for palladium. The stabilization of palladium in 2022 could bring further rapid fluctuations in pricing. Base metal prices like nickel rose steeply in 2021 as well, and will continue to create pricing challenges.

The challenging process of layering metal and ceramic in increasingly small sizes will continue to limit the number of MLCC manufacturers, further intensifying the supply-side challenges.

The New Normal: responding to a challenging MLCC forecast

Our take on the new year: adjusting to the new normal is paramount. Even with recent fluctuations, raw material costs are trending up. Expansive use of MLCCs in consumer technologies will continue to put pressure on the market. Planning flexibility into designs, where possible, looking into alternatives like polymer capacitors, and sourcing from a focused selection of suppliers: potential solutions to meeting MLCC needs are out there.

The bottom line: Variable raw material costs combined with demand for MLCCs means manufacturers should consider flexibility around MLCC sourcing and usage.

詳細はこちら:

- 10 Most In-Demand Electronic Components

- Independent Distributors Prove Indispensable During End-of-Life Market Imbalances

- 3 Ways To Be Prepared For Excess Inventory Conditions

Need help mitigating shortages?