The impact of Covid-19 fuels data center demand, accelerating trends shaping several customer verticals.

Among the trends that have emerged since the start of Covid-19, one in particular stands out — data center demand. Driven by the need to replace in-person communication with virtual alternatives, the rapid adoption of cloud offerings has largely offset the pandemic-induced dip in demand for consumer electronics and smartphones.

To some extent, the pandemic has dramatically accelerated trends that were already brewing. Amazon Web Services, Google, Oracle, and Microsoft are spending billions of dollars on building and equipping new hyperscale data centers.

“We’ve seen two years’ worth of digital transformation in two months,” a Microsoft chief executive said in a statement.

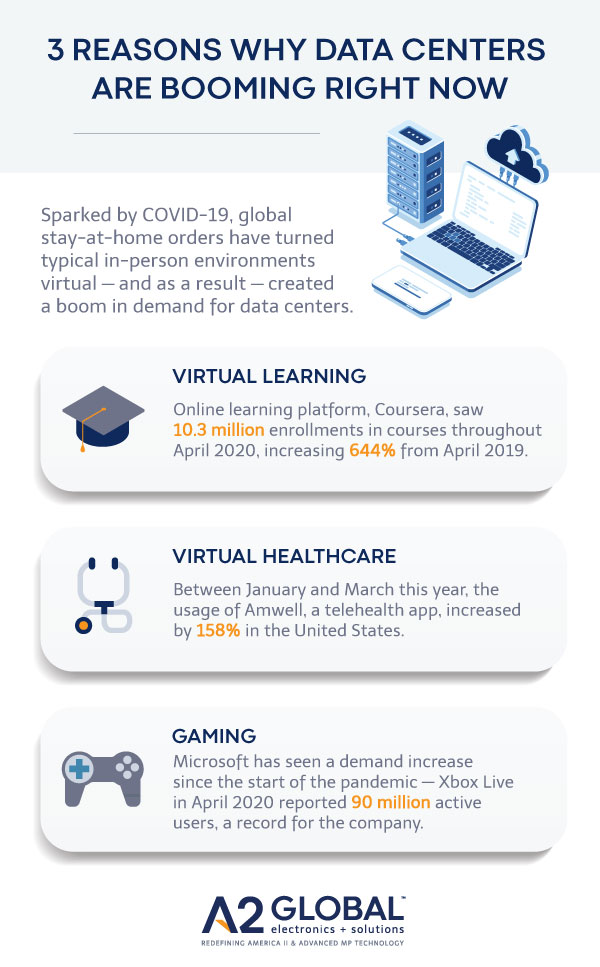

Here’s a closer look at 3 customer verticals driving data center demand:

Virtual learning: Market for online education technology poised for growth

With 1.2 billion children in 186 countries out of the classroom, the impact on e-learning has not gone unnoticed. The 644% uptick in enrollments — totaling 10.3 million — that online learning platform Coursera reported year-over-year in April is just one of many telling stats. Another is Alibaba’s record-breaking deployment of more than 100,000 cloud servers to accommodate its distance learning solution, DingTalk, in just two hours.

Education technology was already a high-growth market before Covid-19 hit. Now, the overall market for online education — language apps, virtual tutoring, online conferencing, etc. — is projected to reach $350 billion by 2025.

Virtual healthcare: Telemedicine may be here to stay

“Unprecedented” may be an overused term these days, but it really is the most apt description for the staggering demand for telehealth services that the healthcare sector has experienced in recent months. Appointments via PlushCare are up by 70%. Amwell had its app use increase by a whopping 158% in the United States between January and March — before the reverberations of Covid-19 were truly felt.

“Any technology infrastructure experiencing such a large increase in demand would experience impact,” an Amwell VP noted.

And the widespread adoption of telehealth may be here to stay even after the virus subsides if it can overcome certain legal, regulatory, and reimbursement challenges, according to The American Journal of Managed Care.

Online gaming: Pandemic fuels booming gaming market

Ninety million monthly active users. That’s how many consumers turned to the Xbox Live online gaming service during the quarantine, a record for the company. The Xbox Game Pass also hit a new high with 10 million subscribers. With such a surging user base, it’s not surprising online gaming plays a significant role in new demand for colocation data center space.

Impact on NAND Flash prices

Demand for cloud services was indeed so high in the first half of 2020 that the NAND Flash market experienced a short supply despite reduced demand for consumer electronics and smartphones. TrendForce, however, projects supply and demand will balance out in the third quarter, resulting in limited changes to NAND Flash prices.

With business as usual on hold for the foreseeable future, demand for data centers is not likely to drop any time soon.

Related posts: