Will digital transformation in the semiconductor industry meet the previous “explosive” forecasts or reflect the natural evolution brought about by the IoT?

Digital transformation has revolutionized businesses in every vertical, including the semiconductor industry. Pre-pandemic forecasts had high hopes for how 5G and the Internet of Things (IoT) would drive transformation among chip manufacturers. But, the past few years have thrown us unprecedented obstacles — from COVID-19 to the Russian invasion of Ukraine. (Read how the Russian-Ukrainian conflict is impacting the semiconductor ecosystem.) Deloitte’s 2021 Semiconductor Transformation Study explores the undeniable impact these dynamic disruptions have had on digital transformation in the semiconductor industry.

As a result, predictions about the impact of the combined power of 5G and the seem to have dimmed, or possibly refocused. In the past, transformation of the industry was framed by its potential to evolve rapidly in response to extreme demand. But, in light of today’s market conditions, the question remains: Can the industry transform fast enough to meet predictions of explosive 5G-driven demand, or will digital transformation in the semiconductor industry reflect the natural evolution brought about by the expansion of IoT? Let’s break it down.

Is there a failure to launch for digital transformation in the semiconductor industry in the industrial sector?

Current forecasts predict that the vast majority of 5G connections will be through smartphones and other mobile devices in the near future. Mission-critical services and fixed wireless access are likely to remain niche for “many years,” according to CCS Insight, a global analyst company focusing on mobile communications and the Internet. CSS comments:

“5G is about creating a network that can scale up and adapt to radically new applications. For operators, network capacity is the near-term justification; the Internet of Things (IoT) and mission-critical services may not see exponential growth in the next few years but they remain a central part of the vision for 5G. Operators will have to carefully balance the period between investment and generating revenue from new services.”

Thus, the vision of 5G and IOT revolutionizing the manufacturing world has slowed somewhat. Of primary concern: do manufacturers feel it’s worth the risk to invest in technology that must function in a niche fashion?

EE Times noted recently that views on 5G and IoT are shifting to a more “realistic view of how 5G and IoT interoperate in the industrial realm.” This view emphasizes that digital transformation will play out over not years but decades, as infrastructure in new facilities develops around 5G technologies, rather than injecting them directly into existing infrastructure.

This goes for semiconductor manufacturers themselves. To capitalize on 5G in their own processes, new semiconductor facilities will need to incorporate technologies that can effectively utilize 5G connections to incorporate things like AI, blockchain, and IoT in ways that have meaningful results like testing and consistency.

Semiconductor demand from 5G growth: Are there limits on the potential “explosive growth” forecasts?

In the past we predicted sweeping growth in several areas, particularly radio frequency front-end (RFFE). This is a key module allowing devices to connect to a mobile network, which allows a mobile handset to send and receive data, high-volume smartphones, and mobile handsets.

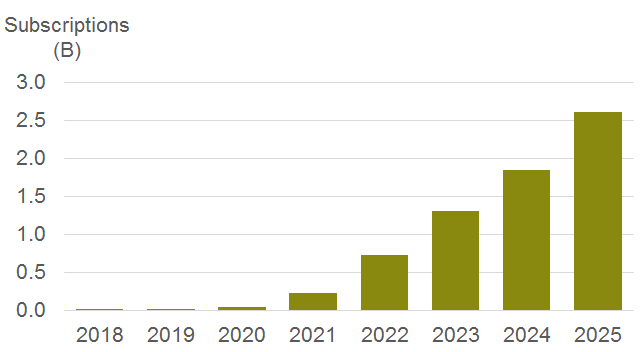

The high demand for consumer devices remains the primary driver behind 5G growth. Some predictions even put 5G network subscriptions at 2.6 billion in 2025, meaning more than one in five mobile connections will use 5G, but with caveats. Challenges may include how networks are deployed and operator and consumer willingness to embrace the new technology, as well as regulatory issues.

5G subscriptions, 2018-2025

Source: CCS Insight Market Forecast: 5G Subscriptions, 2018-2025

Specific to semiconductor manufacturing, challenges around developing and scaling new tech may slow production. To work with the needs of customers to meet demands, semiconductor manufacturers will have to continue to evolve to understand new uses and needs as 5G expands. This will take time to anticipate these unique needs and scale production in an effective way.

Digital transformation of manufacturing processes in the form of 5G-powered IoT has not taken off yet. But, the demand for semiconductors to run the 5G nodes has the potential to drive further innovation in cost effectiveness and increased production, but potentially in longer timeframes than first forecasted. Consumer and mobile devices will likely lead the way in the expansion of 5G, demanding investment from semiconductor manufacturers in the face of potential consumer challenges. This reflects more of a naturally evolving process of digital transformation in the semiconductor industry, rather than unmitigated growth.

Read more: